TMS Brokers w hedgingu

Dom Maklerski TMS Brokers kieruje się bardzo rygorystyczną polityką w podejściu do hedgingu, która polega na:

- Identyfikacji wszystkich źródeł ryzyka walutowego w przedsiębiorstwie.

- Dokładnym oszacowaniu ryzyka.

- Ciągłym monitorowanie pozycji ryzyka walutowego.

- Określeniu optymalnych momentów realizacji strategii.

- Analizie struktury kapitału i modelowanie portfela kredytowego.

- Dynamicznym zarządzaniu pozycjami zabezpieczającymi.

- Kompleksowej ocenie wyników.

Skuteczność naszych analiz oraz rekomendacji wyznaczają kryteria, które sam tworzysz. Do określenia wskaźników skuteczności stosujemy szczegółowe cele.

Właściwa transakcja we właściwym czasie

Nawet najlepiej zaplanowana strategia nie przyniesie efektów, jeśli nie zostanie wykonana w odpowiednim czasie. Nasi doradcy monitorują ekspozycje walutowe klientów i identyfikują optymalne okresy realizacji strategii hedgingowej. Wyczucie czasu jest jednym z najtrudniejszych zadań w zarządzaniu ryzykiem rynkowym walut. Nasi specjaliści zapewniają zarówno analizę techniczną, jak i fundamentalną i dzielą się swoją specjalistyczną wiedzą podczas licznych szkoleń oraz organizowanych przez nas seminariów.

Zasady skutecznego zabezpieczenia/hedgingu

Oto sześć zasad efektywnego zabezpieczenia, które odzwierciedlają podejście do zarządzania ryzykiem TMS Brokers:

- Zabezpiecz zobowiązania wynikającego z wyglądu i należności w danej walucie w danym horyzoncie czasowym. Zabezpieczyć powstałą pozycję netto.

- Ustaw współczynnik zabezpieczenia - określ, jaki procent Twojego ogólnego ryzyka walutowego ma zostać zabezpieczony i ustawić akceptowalny stopień narażenia na ryzyko walutowe.

- Dywersyfikuj - wykorzystaj szeroki zakres instrumentów finansowych i przeanalizuj kilka optymalnych momentów rynkowych, aby zwiększyć elastyczność i skuteczność zabezpieczenia.

- Zadbaj o zabezpieczenia przed ryzykiem - wykonywanie transakcji hedgingowych przed szkodliwym ruchem na rynku. Następnie optymalizuj swoją pozycję na korzystnych rynkach.

- Nie uznawaj ekstremów - ani inercja, ani spekulacje nie służą celom zabezpieczania. Zrozum, że bezczynność jest spekulatywna.

- Monitoruj rynek i zarządzaj swoimi pozycjami. Nie wahaj się zamknąć zabezpieczenia przed dojrzałością.

Dostępne instrumenty

Polski rynek walutowy Forex oferuje tak szerokie spektrum instrumentów do zarządzania ryzykiem, że nawet doświadczony inwestor może mieć trudności z wyborem odpowiednich narzędzi. Fakt, że właściwy wybór zależy częściowo od dokładnych prognoz, dodatkowo komplikuje decyzję inwestycyjne.

Wasze ulubione instrumenty

- Transakcje typu "spot" - transakcje typu "slots" służą do zabezpieczenia bieżących kursów walut. Firmy, które są w posiadaniu waluty obcej, mogą dokonać transakcji spotowej w celu wymiany na złoty polski. Przeliczone wpływy zostaną zaksięgowane na koncie firmy w ciągu dwóch dni. Z drugiej strony, mając polski złoty, spółka może, w drodze transakcji spotowej, kupić walutę obcą.

- Automatyczne zaokrąglanie transakcji spotowych - firmy, które korzystają z platform online, mogą automatycznie dokonywać transakcji na miejscu. Zaletą tego podejścia jest możliwość zablokowania obecnego kursu walutowego, nawet jeśli data płatności nie została zdefiniowana. To bardzo elastyczne podejście umożliwia handel z zleceniami spoczynku w celu skorzystania z wahań kursów walut.

- Transakcje terminowe - firmy, które mają dobrze określone przepływy pieniężne w walutach obcych mogą ograniczyć ryzyko walutowe poprzez zabezpieczenie kursu walutowego w przyszłości. Umowy forward zabezpieczają przyszły kurs walutowy niezależnie od późniejszych zmian rynkowych.

- Transakcje opcji - opcjonalnie transakcje mogą skutecznie zabezpieczyć się przed niekorzystnymi ruchami na rynku, a jednocześnie zachowują potencjał wzrostu. Transakcje typu option zabezpieczają importera przed wyższymi kursami walutowymi i mogą pozwolić na dodatnie zyski, jeśli kursy walut się poprawią. Eksporter polscy, który zatrudnia strategię opcyjną, zabezpiecza silniejszy złoty polski, a jednocześnie utrzyma potencjał wzrostu z deprecjacji krajowej waluty.

- Transakcje opcji bezpłatnych transakcji - jeśli umiarkowane wahania kursów walut mają niewielki wpływ na Twoje dochody, strategia oparta na opcjach, aby zabezpieczyć kursy wymiany w obrębie zakresu, to strategia zyskowna.

Sprawdź również:

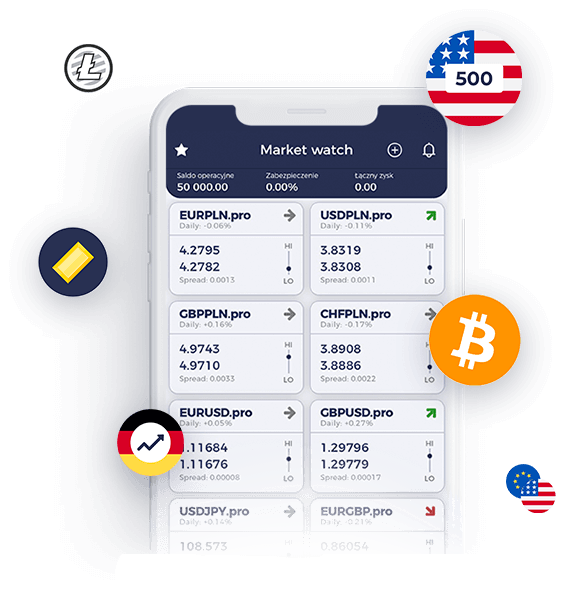

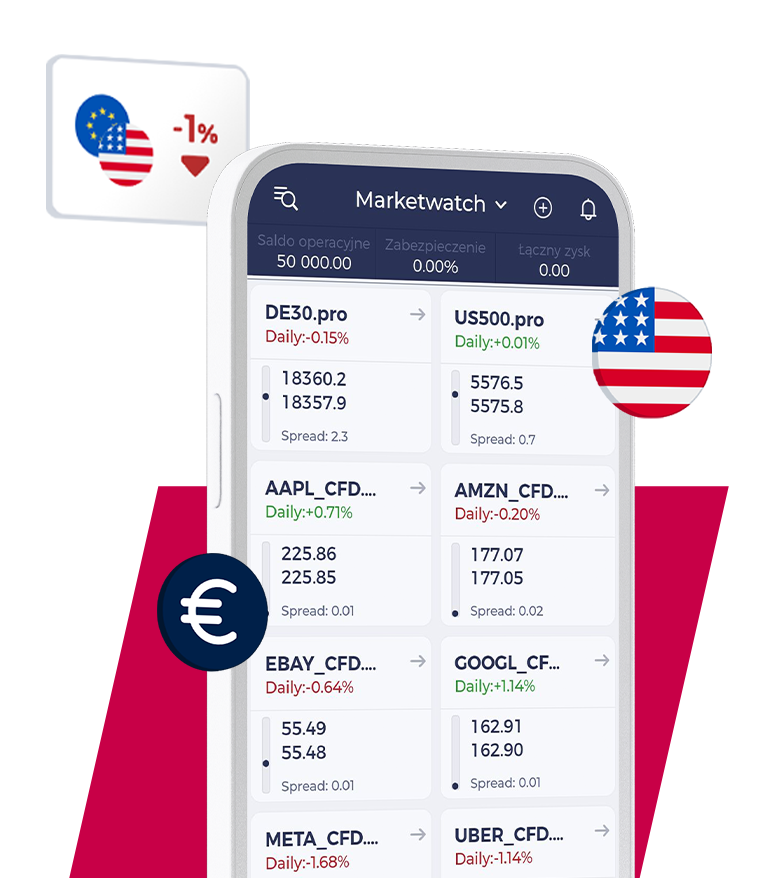

Przetestuj bezpłatnie

aplikację OANDA TMS Brokers

- Dostęp do wirtualnego salda 50 000 złotych

- Prosty tutorial po aplikacji dla początkujących

- Możliwość testowania strategii inwestycyjnych bez ryzyka

- Dostęp do materiałów edukacyjnych (w tym ebooki i podcasty)

- Bezpłatne konto demo ważne aż 180 dni

Sprawdź raport inwestycyjny na 2025 rok

- Wszystko, co musisz wiedzieć o giełdzie, żeby zacząć inwestować

- Rynki finansowe okiem Łukasza Zembika i Krzysztofa Kamińskiego

- Kilkadziesiąt stron eksperckiej wiedzy od praktyków